How GenAI Is Rewriting the Accounting Cycle

The Institute of Chartered Accountants in England and Wales (ICAEW) recently published a powerful article titled “How GenAI Can Save You Time During the Accounting Cycle”, and in my opinion, neither does headline exaggerate nor the content disappoint.

It’s a timely, practical reminder that AI isn’t just a buzzword circling the accounting profession, it’s now embedded in the very rhythm of how modern firms are coming to work. From initiation through to reporting, Generative AI is beginning to reshape what “month-end” even means.

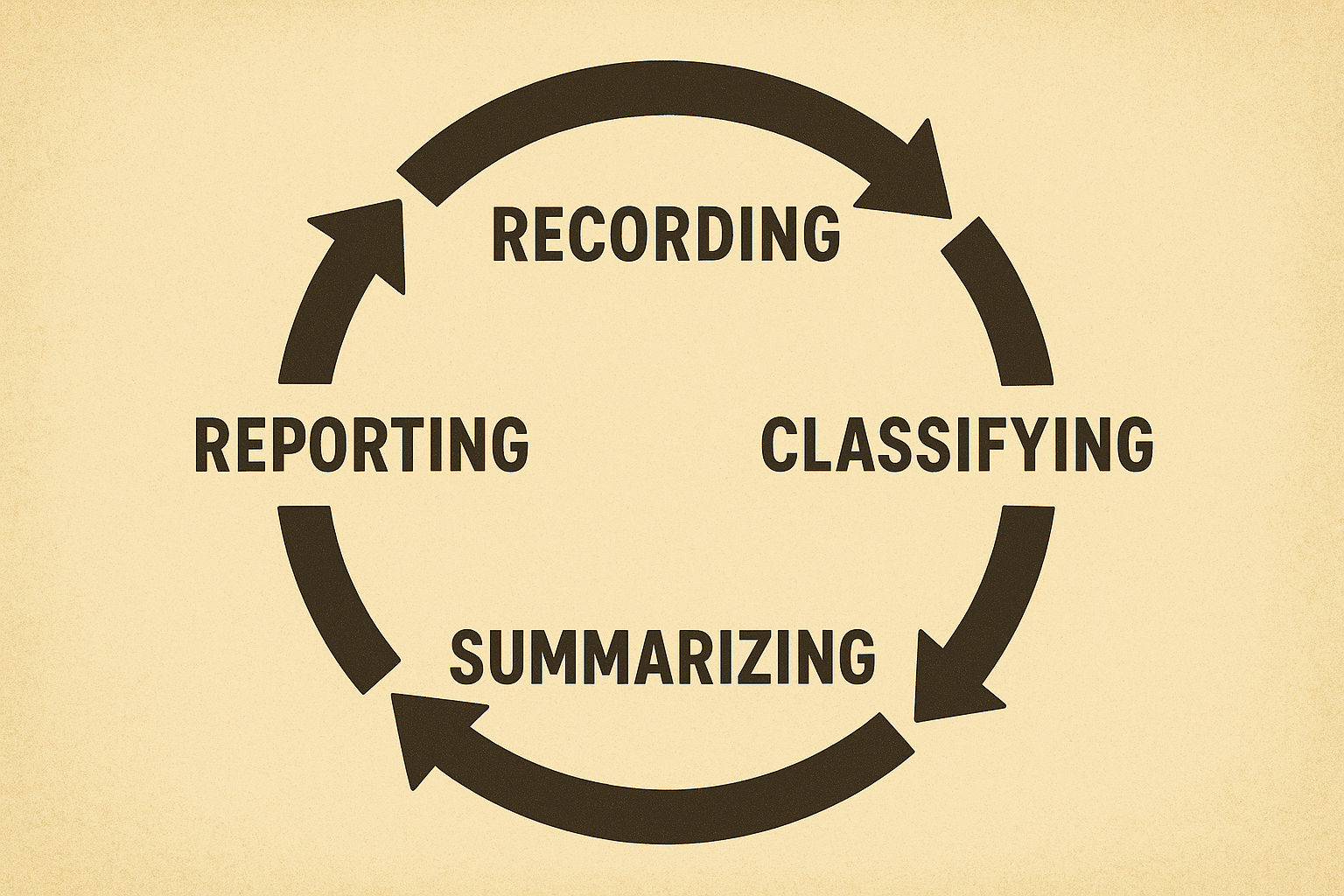

The Four Stages of the Accounting Cycle

ICAEW outlines four stages where GenAI is already saving time and sanity for finance teams:

Initiation – Reading the noise.

GenAI can now scan emails, PDFs, and unstructured data to spot economic events that might otherwise be buried in inboxes. It’s like giving your accounts payable clerk a sixth sense.Recording – From plain English to journal entries.

Instead of staring at an agreement and manually coding debits and credits, GenAI can take a description of the transaction and suggest complete journal entries, mapped to your chart of accounts.Processing – Reconciliation, at light speed.

Upload your datasets, let GenAI match and flag exceptions, and spend your time reviewing the interesting outliers rather than chasing mismatched pennies.Reporting – Drafting with depth.

Narrative commentaries, variance analysis, and first-draft disclosures, all prepped automatically, freeing accountants to focus on what matters most: insight, not admin.

The real takeaway? GenAI isn’t taking the accountant out of accounting, it’s taking the drudgery out of it.

Why This Matters (more than ever)

At Bots For That, we’ve seen first-hand what happens when firms combine their expertise with the right automation and AI tools. The change isn’t just about speed, it’s about visibility, consistency, and confidence.

GenAI gives accountants the ability to see patterns, not paperwork. It turns reactive work into proactive insight. And yes, it helps reclaim time, but what really matters is what you do with that time.

Spend it on clients.

Spend it on strategy.

Spend it on innovation.

A Word of Balance

The ICAEW is right to stress that human oversight still matters. Generative AI can produce, suggest, and summarise, but accountants interpret, investigate, and assure.

That’s not a weakness. It’s the partnership that makes the technology powerful. AI creates scale; accountants create trust. Together, they redefine what quality work looks like.

So, What's Next for Firms?

GenAI is already here, not in the future, but in your inbox, your ledger, and your close checklist. The question is: how ready are you to use it well?

Here are a few simple prompts to help you turn inspiration into action:

Where are the friction points? Which parts of your accounting cycle still rely on manual effort, rework, or spreadsheet gymnastics?

What could you automate or augment first? Think about quick wins, like reconciliations, variance analysis, drafting reports.

Who in your team needs to evolve their role? Freeing up time only works if people know how to use that time differently, for clients, analysis, and better decisions.

Is your data (and process) AI-ready? GenAI is only as smart as the information you feed it. Clean, standardised, and secure data is the foundation.

The Bottom Line

GenAI isn’t replacing accountants. It’s replacing the version of accounting that wastes their potential.

The firms who embrace it thoughtfully, combining great tech with great governance, will close their books faster, serve clients better, and grow stronger.

The future of accounting isn’t about doing the same things quicker. It’s about doing smarter things entirely.

Discover more on this topic by taking a look at this article