Is Your Firm Really Ready for AI?

Is your firm really ready for AI? The results are in — and they’re fascinating.

AI isn’t just a buzzword anymore — it’s fast becoming a non-negotiable for modern accounting practices. But how prepared is your firm really? That’s what we set out to discover with the AI Readiness Quiz — a quick and practical tool for bookkeepers and accountants to see where they stand when it comes to AI, automation, and future-fit operations.

It’s not a pass/fail test. It’s a mirror — designed to highlight strengths, expose blind spots, and inspire smart next steps. Since launching, dozens of firms have taken part. The results are in, and they reveal a fascinating snapshot of where the industry is… and where it still needs to go.

The Results So Far

Let’s break down the data, question by question, starting with the average score:

69% AI readiness — a solid start, but with definite room for growth.

Here’s what your peers had to say:

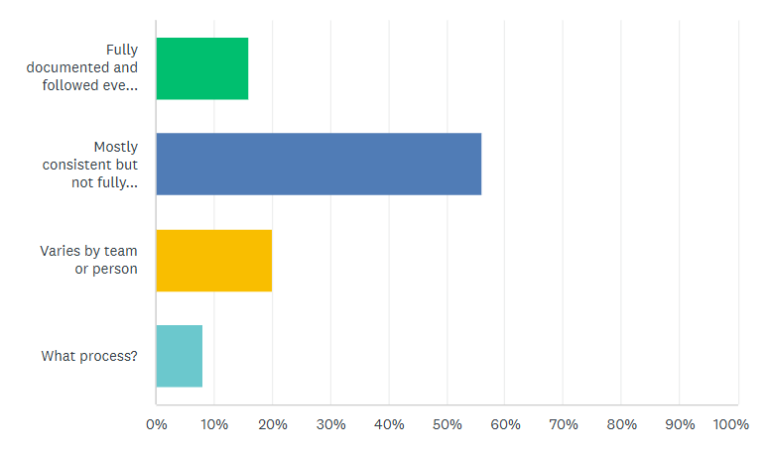

Q1: How would you rate the consistency of your internal processes (e.g., onboarding, month-end close, VAT returns)?

Top answer: “Mostly consistent but not fully documented”

While a few firms have everything buttoned up and followed to the letter, most are still running processes that vary between people or aren’t fully documented — leaving room for error and inefficiency.

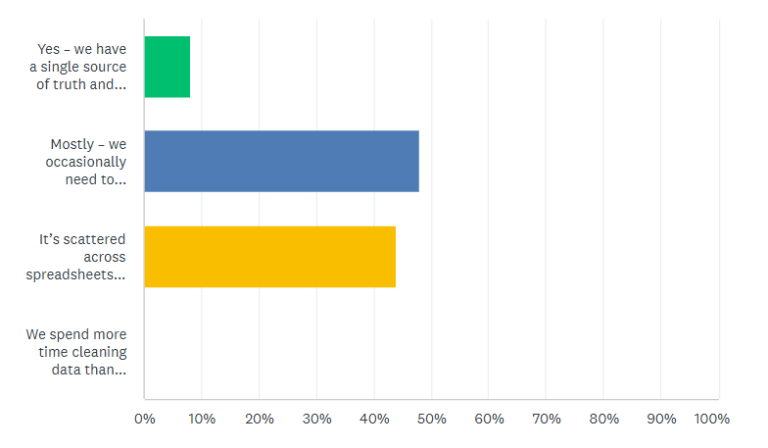

Q2: Is your client and transactional data centralised, clean, and easily accessible?

Top answer: “Mostly – we occasionally need to reconcile or chase info”

Clean, centralised data is the foundation for effective automation — but only a minority reported having a true “single source of truth.” Most are still doing a bit of digital detective work.

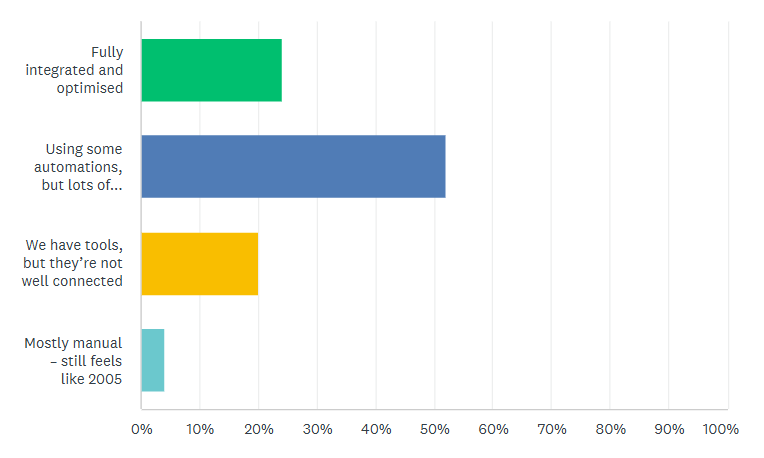

Q3: How automated are your workflows using cloud accounting tools (e.g., Xero, QuickBooks, Dext, ApprovalMax)?

Top answer: “Using some automations, but lots of manual work remains”

The tools exist, but they’re often underutilised or disconnected. Firms have made progress but haven’t yet unlocked the full efficiency potential of their app stack.

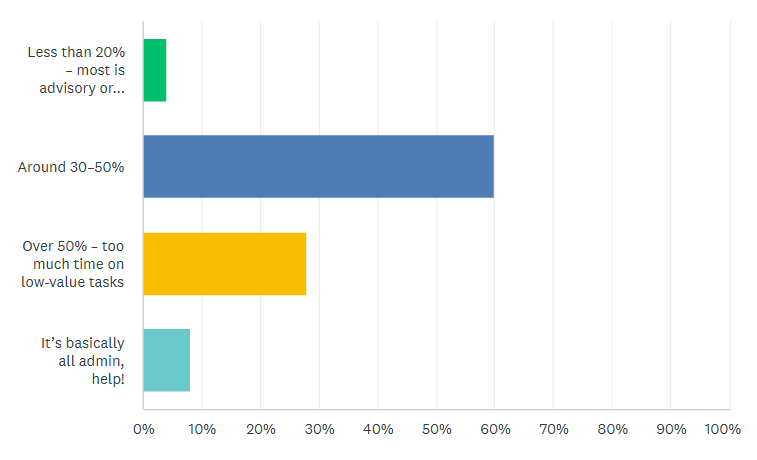

Q4: How much of your team’s time is spent on repetitive admin (e.g., chasing receipts, reconciling transactions)?

Top answer: “Around 30–50%”

A significant portion of team time is still tied up in low-value admin. This is where automation can make the biggest impact — reducing burnout, increasing capacity, and freeing up time for higher-value work.

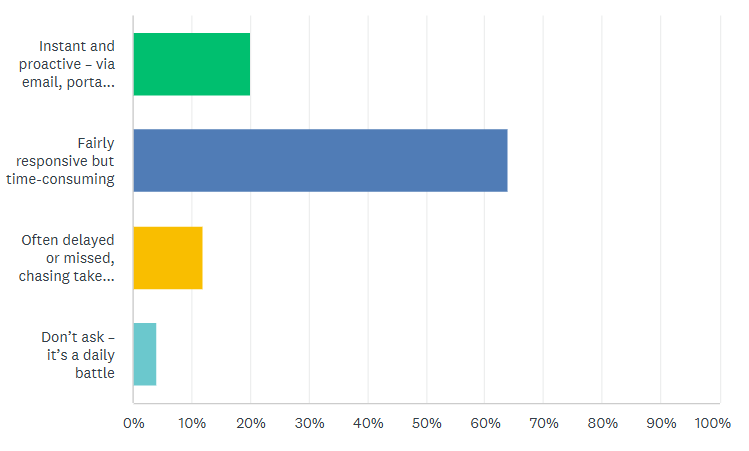

Q5: How responsive and streamlined is your communication with clients (e.g., document requests, Q&A, reminders)?

Top answer: “Fairly responsive but time-consuming”

Communication is happening, but it’s often clunky. Automating document requests or using smart portals can transform this — making things smoother for clients and staff alike.

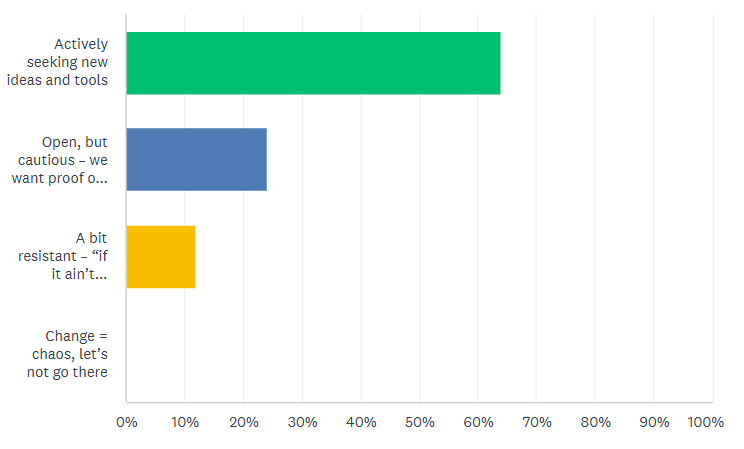

Q6: How open is your firm to exploring automation and AI-driven improvements?

Top answer: “Actively seeking new ideas and tools”

The mindset is strong — most firms are curious and willing to evolve. And that’s great news, because openness to change is one of the strongest predictors of long-term success in this space.

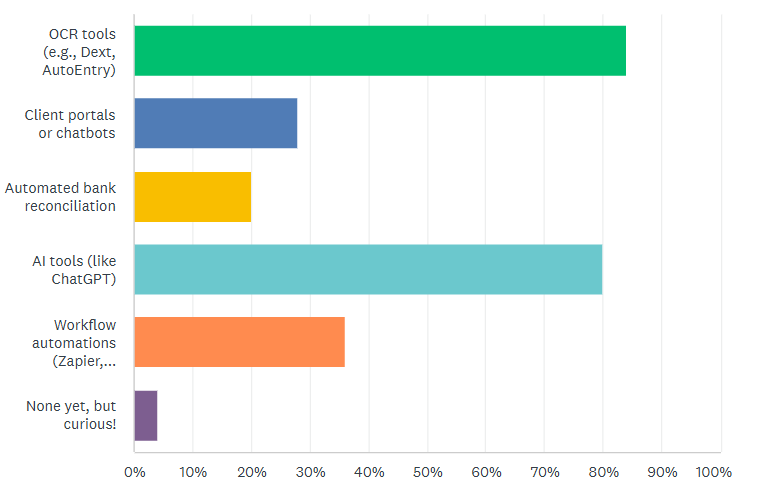

Q7: Which of the following are you already using? (Tick all that apply)

Most selected tools:

OCR tools (e.g., Dext, AutoEntry)

Automated bank reconciliation

Workflow automations (Zapier, Beanies, etc.)

AI tools (like ChatGPT)

Client portals or chatbots

Most respondents are already experimenting with automation — though some haven’t started yet. The range of tools used shows that the journey to AI readiness looks different for every firm.

So, What’s the Verdict?

On average, firms scored 69% on our AI Readiness scale — a strong start, but with clear opportunities for growth.

If you want to future-proof your firm, reduce admin burden, and retain top talent, embracing automation and AI isn’t a luxury — it’s a necessity. But knowing where to begin? That’s often the trickiest part.

Get in touch now to future proof your firm