New Year, New Processes

We’re officially at the end of 2025, and with 2026 just around the corner, now is the perfect time to pause, reflect, and reset. For accounting firms, a new year isn’t just about new clients or new targets, it’s about new ways of working. Starting the year with efficient, well thought out processes can make the difference between another year of firefighting… or a year of real progress.

Below are five practical actions any accounting firm can take to strengthen their internal processes and set themselves up for a smoother, more successful year ahead (unless, of course, you’ve already mastered them).

1. Clean up client communication and internal visibility

One of the biggest pain points in firms is simply knowing what’s going on. Who’s waiting on client information? Which jobs are in progress? What’s blocked, and why?

Centralising communication is key. Client emails, notes, phone call summaries and task updates should all live in one place, accessible to the right people. Whether it’s a practice management system or a shared workflow tool, everyone in the firm should be able to quickly see a client’s current status without chasing colleagues or digging through inboxes. Clean communication setups reduce duplicated work, missed messages, and that constant feeling of being “out of the loop”.

2. Standardise core workflows

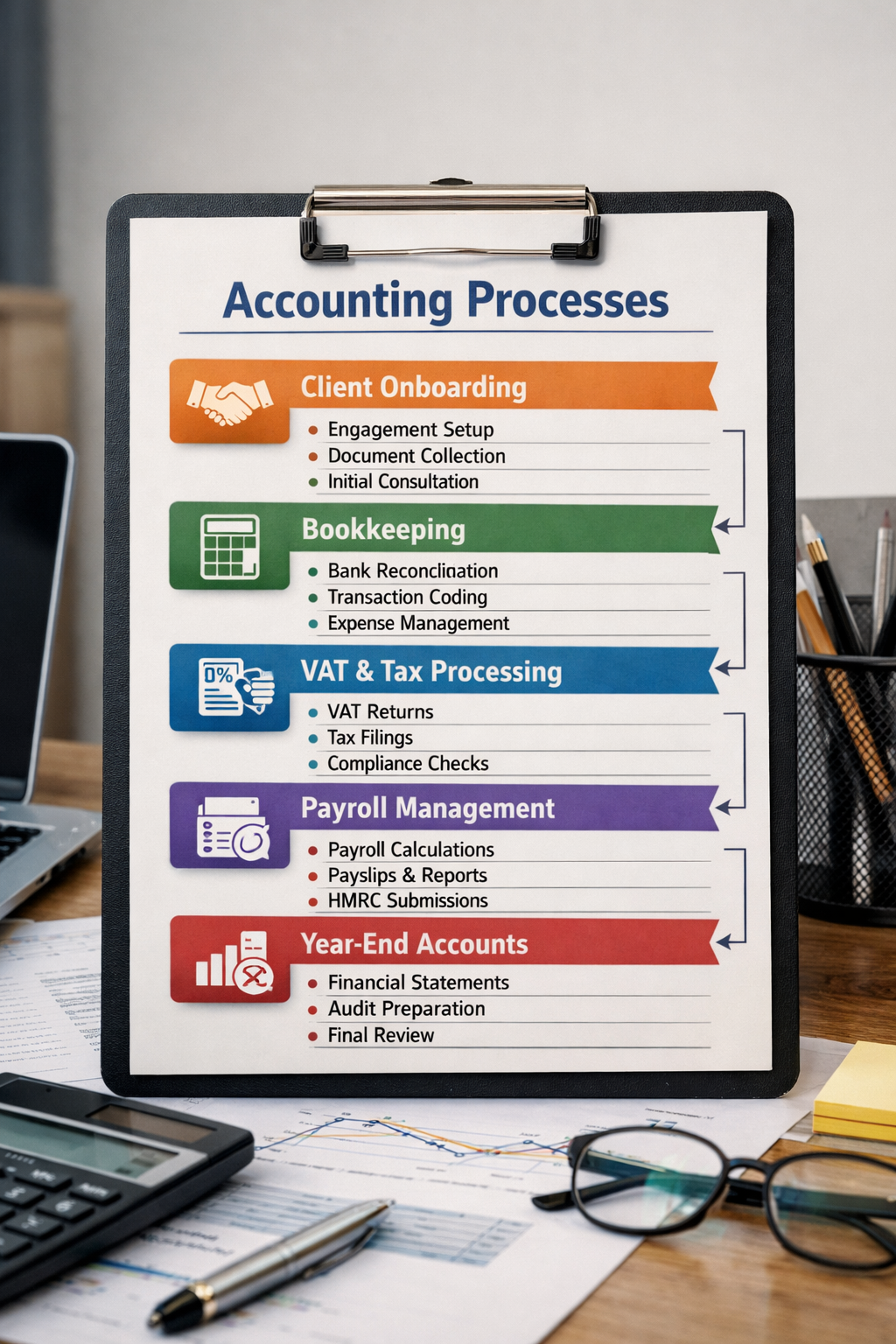

If every team member completes the same task in a slightly different way, inefficiency creeps in fast. Processes like onboarding, month end close, VAT returns, payroll runs and year end accounts should have clearly documented steps.

This doesn’t mean rigid or over complicated checklists, but clear guidance on what needs to be done, in what order, and using which tools. Standard workflows help new starters get up to speed faster, reduce errors, and make it much easier to spot bottlenecks or gaps when things go wrong.

3. Tidy up data and transaction handling

Messy data creates messy outcomes. Bank feeds not reviewed regularly, green matches accepted without checks, and inconsistent coding all lead to hours of clean up later on.

Firms should review how transactions are handled day to day. Are rules set up properly? Are green matches being reviewed sensibly rather than blindly accepted? Are suspense accounts monitored regularly? Putting a bit more structure into daily and weekly checks can massively reduce the time spent fixing problems at month end or year end.

Don’t have time to make checks? This is where the help of automation tools can come in handy

4. Automate repetitive manual tasks

Many firms are still spending huge amounts of time on tasks that could be automated, such as chasing client information, sending reminders, reconciling balances, or generating standard reports.

Review where your team is manually copying data, switching between systems, or repeating the same steps client after client. Even small automations can free up hours each week, giving your team more time to focus on higher value work and client relationships rather than admin.

5. Review roles, responsibilities and ownership

Disorganisation often comes from unclear ownership. If no one knows who is responsible for a task, it either gets done twice… or not at all.

Clearly define who owns each part of your processes, from client onboarding to final review. Make sure responsibilities are visible and understood across the firm. When ownership is clear, accountability improves, handovers are smoother, and work moves forward without constant follow ups.

Why clean processes matter so much

Poor processes don’t just slow firms down, they actively cost money. Time spent on manual tasks eats into margins. Disorganisation leads to stress, burnout, and mistakes. Fixing messy processes later is far more expensive than getting them right from the start.

For accountants, these issues often show up as long hours, constant interruptions, missed deadlines, and that underlying feeling of being busy but not productive. Clean processes reduce friction, create clarity, and allow teams to work with confidence rather than urgency.

Make this the year things change

This is the year things can be different. With a little guidance and focused effort, 2026 can be the year you transform how your firm operates.

Whether your goal is to break into the top 100, remain there, or simply build a calmer, more profitable practice, the actions outlined above point you in the right direction. New year, new processes — and a real opportunity to build the most efficient and successful firm you can.