The MTD Tech Stack: Creating the Perfect Formula

If you’re feeling unsure about the best direction to take when preparing for Making Tax Digital (MTD), you’re not alone. Between conflicting advice, endless software options, and the looming deadlines, it’s easy to feel like you’re treading water in a sea of uncertainty. Many accountants and business owners are asking the same question: What’s the smartest, simplest way to set up for MTD without drowning in complexity?

The answer lies in building the MTD tech stack; a streamlined set of tools that work together, minimise manual effort, and keep you compliant without the headaches.

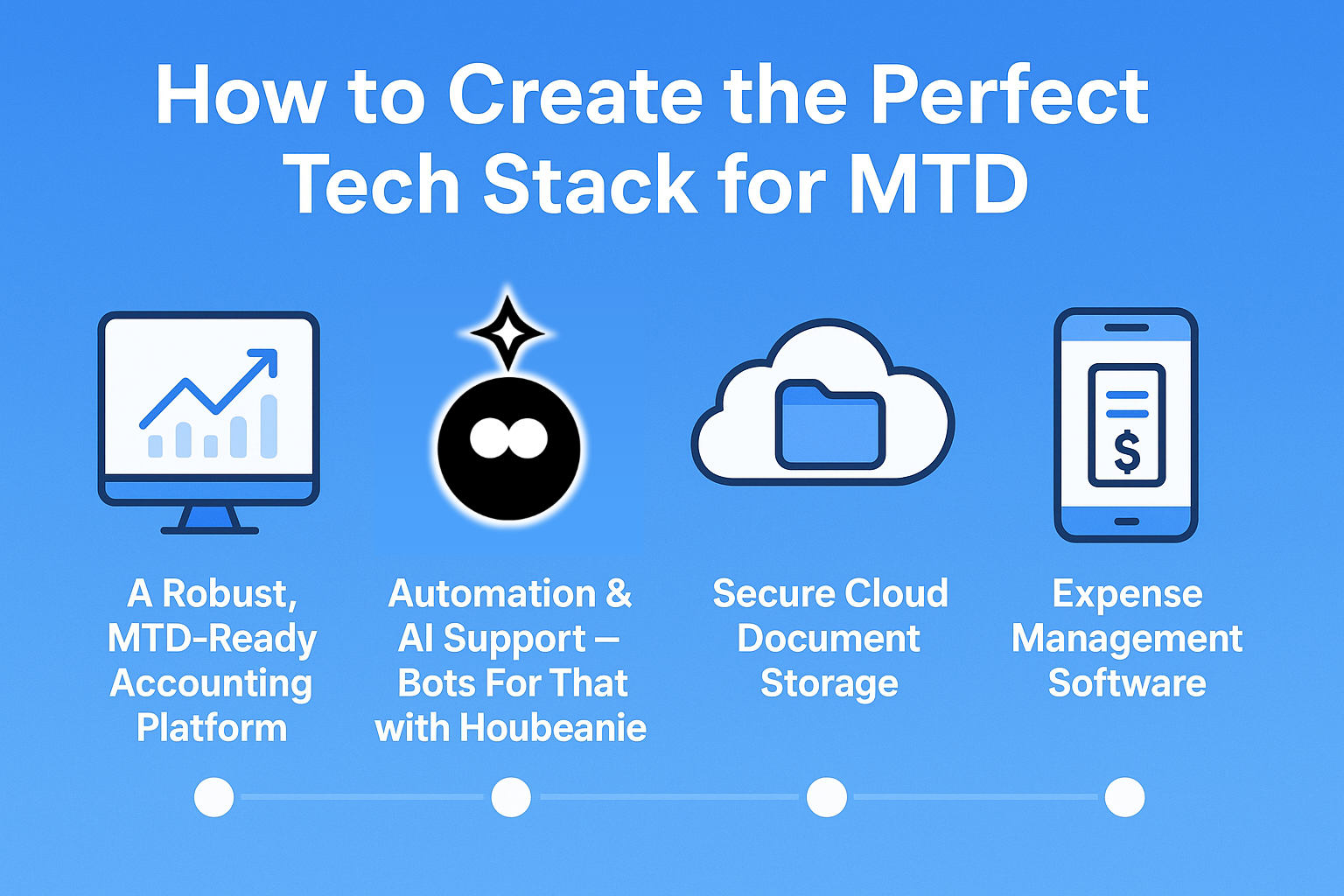

The Essentials for the MTD Tech Stack

When it comes to MTD, less is more. The goal isn’t to have every shiny app on the market, it’s to have the right combination of tools that save you time, reduce human error, and keep everything in one smooth flow. Here’s what should be on your shortlist:

1. A Robust, MTD-Ready Accounting Platform

Think of this as the backbone of your MTD setup. Platforms like Xero, QuickBooks Online, and Sage are HMRC-recognised, user-friendly, and built to handle MTD submissions with ease. They also integrate well with other apps, meaning you won’t need to juggle data between multiple systems.

2. Automation & AI Support

While your accounting software handles compliance, you still have countless repetitive tasks that eat up your day—bank reconciliation, invoice chasing, data entry… and that’s before you even get to advisory work.

That’s where Bots For That comes in. Our AI agent, Houbeanie, is like your personal sidekick ready to take on the mundane, manual jobs so you can focus on higher-value tasks. From automatically updating records to acting as an email responder, Houbeanie is the efficiency boost that turns MTD from a chore into a smooth process.

3. Secure Cloud Document Storage

MTD is about digital records, so a secure cloud storage platform is essential. Tools like Dropbox Business or Google Workspace allow you to store, organise, and share records easily. This means no frantic searching for missing documents, you’ll always be ready for audits or client queries.

4. Expense Management Software

If you or your clients are still manually tracking expenses, now is the time to stop. Tools like Dext or Expensify make it effortless to capture receipts, categorise expenses, and sync directly with your accounting software, keeping your MTD records complete and accurate.

Why the Right Tech Stack Matters

With MTD, the stakes are high—non-compliance means penalties, but overcomplicating your tech can lead to inefficiency and frustration. The perfect MTD tech stack works like a well-oiled machine:

Your accounting platform ensures compliance.

Houbeanie and automation cut down your admin load.

Cloud storage keeps everything in one secure place.

Expense management makes record-keeping seamless.

With the right MTD tech stack, you’ll turn what feels like a storm into a calm, predictable process. No overwhelm, no app fatigue—just a clean, efficient setup that makes the arrival of MTD a breeze.